We are very proud of all of our highly rated reviews and customer feedback. Check out what our customers are saying!

Click to read what our customers are saying!

Upstate New York Insurance for Auto, Home, Flood, and Commercial Requirements

At SIB Insurance, we cover upstate New York and surrounding regions. We understand that insurance has become much more complex over the last several years, with new and changing guidelines and policies. It has been and will always be our mission at SIB Insurance to help our customers navigate many uncertain details and options regarding insurance coverage.

We have been privileged to see many of our families grow their businesses and move into their homes. As a brokerage service, we need to have a deep understanding of our client’s needs and requirements for now and future generations. We serve the needs of both residential and commercial clients in cities like Buffalo, Albany, Rochester, Ithaca, Syracuse, and the entire Upstate New York region.

Award Winning Personalized Customer Service

When buying insurance in Upstate New York, working with SIB Insurance offers a distinct advantage, especially for those seeking the personal touch. Unlike companies, we take the time to understand your unique needs, whether it’s for home, auto, or business coverage. We can tailor policies to fit your specific circumstances, ensuring you get the protection you need without unnecessary add-ons. With our knowledge and experience, we provide valuable insight, helping you navigate the complexities of insurance while ensuring you’re fully covered. You’re not just a policy number at SIB Insurance, you’re a valued client.

We have over 20 years of experience in servicing our clients

We have hundreds of 5-star reviews and satisfied clients

We work with many highly accredited insurance companies to find the right fit

We proudly serve thousands of satisfied residential and commercial clients

We will always proactively monitor policies over time, advising clients on updates or changes as life circumstances evolve, such as buying a new home, leasing or buying a new automobile, or expanding a business. When claims arise, our personal broker advocates for all of our clients as we help streamline documentation and quickly follow up with insurers to secure timely, fair settlements. This attentive, client-centered approach not only ensures comprehensive coverage but also fosters peace of mind and confidence in having an Insurance Brokerage firm that is genuinely invested in protecting their clients’ financial well-being.

GET A QUOTEAffordable Auto, Home, Business, and Flood Insurance in Upstate New York

Auto insurance in Upstate New York is essential for protecting drivers from financial liability in cases of accidents, damage, or theft. With varying weather conditions and rural roads, comprehensive coverage is often recommended to include both collision and non-collision incidents like storms or wildlife-related accidents.

Homeowners Insurance

When buying homeowners insurance in upstate New York, it’s essential to consider the area’s specific risks, including severe winter weather, potential flooding, and rural property concerns. Policies should cover not only the structure of the home but also protect personal belongings, liability, and additional living expenses in case of damage. SIB Insurance will give you options that address risks like snow or ice damage, and inquire about flood insurance if your property is near a water source.

Bundling both auto and home insurance can offer substantial savings, as many providers in the region offer multi-policy discounts.

GET A QUOTEBusiness Insurance

Buying business insurance in upstate New York requires tailoring your coverage to the specific risks your business might face, such as harsh winter conditions, rural infrastructure, or industry-related liabilities. Depending on your industry, you may also need coverage for vehicles, equipment, or professional liability. SIB Insurance will compare quotes from different insurers and review policy details which help you find comprehensive coverage that fits your business needs while ensuring you are prepared for potential weather-related disruptions or operational risks.

GET A QUOTE

Flood Insurance

Flood insurance is particularly important in areas near rivers and lakes. Unlike standard home insurance, it covers damage caused by water overflow from rivers, heavy rain, storm surges, and other natural events that lead to flooding. Flood insurance can help cover the costs of repairing or replacing your home and belongings, saving you from paying potentially devastating out-of-pocket expenses.

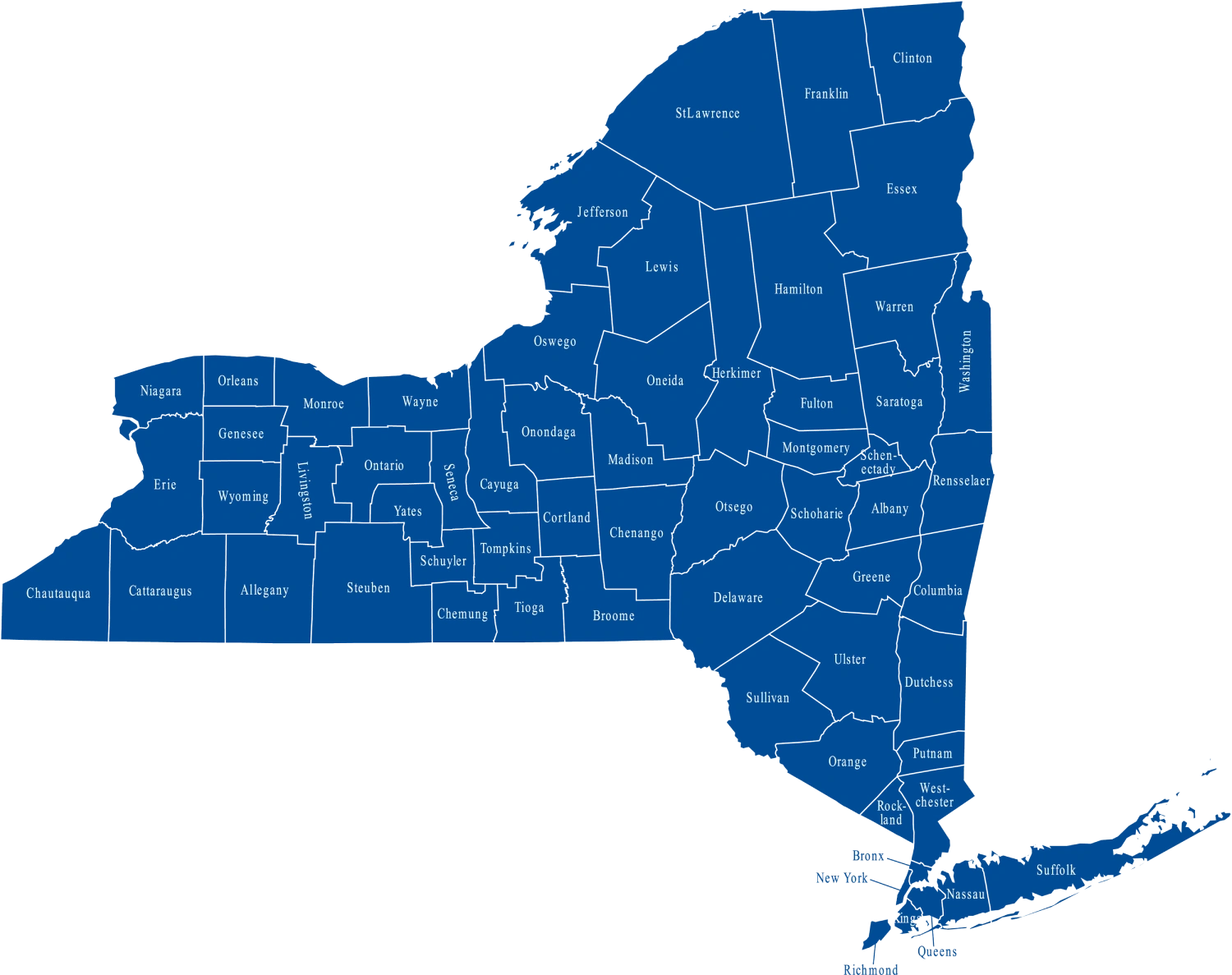

GET A QUOTEAreas Served

At SIB Insurance we cover all types of insurance in all New York state counties

- Erie County

- Monroe County

- Richmond County

- Onondaga County

- Orange County

- Rockland County

- Albany County

- Dutchess County

- Saratoga County

- Oneida County

- Albany County

- Dutchess County

- Saratoga County

- Oneida County

- Niagara County

- Broome County

- Ulster County,

- and more